utah state tax commission property tax division

Property Tax Division Standards of Practice. Interim value and tax statistics reports 1989- Series 22378.

Property Tax Utah State Tax Commission Utah Gov

Public utility and natural resources recapitulations.

. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114-0530. It does not contain all tax laws or rules. Rev April 2021.

Through this overall audit effort the. The owner of a centrally-assessed property has a right to file an appeal of the assessment by August 1. Table of Contents.

Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134. Property tax assessment system from the Utah State Tax Commission. The Auditing Division of the Utah State Tax Commission is involved in conducting audits on most taxes the Tax Commission is responsible to oversee.

Property Tax Division Series 2496 record the final assessments. Express Mailing Address Fedex UPS etc Utah State Tax Commission. Natural resources assessment records from the Utah State Tax Commission.

Tax rates are also available online at Utah Sales Use Tax Rates or you can. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114. Future Candidates will complete course 101A which is the Appraisal Institute.

In HTML or XML. File electronically using Taxpayer Access Point at. Property Tax Division.

Utah State Tax Commission. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. This is the final presentation of this specific version of the course by the Utah State Tax Commission.

Standard 1 Board of Equalization. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Treasurers Office Unclaimed Property Division 168 N 1950 W Suite 102 Salt Lake.

Property Tax Division Series 9955 is the assessment system. This website is provided for general guidance only. Utah State Tax Commission.

If you have questions regarding the education classes or the appraiser designations contact Tamara Melling Property Tax Education Coordinator at 385-377-6080 or tmellingutahgov. Assessors returns of mining companies. Public utilities assessment records from the Utah State Tax Commission.

UTAH STATE TAX COMMISSION DIVISION OF REVENUE ACCOUNTING 10226 FINAL DISTRIB BALANCE OWED Utah Code 59-12-1218bi or 59-12-2218biiA TOTAL PAID OCTOBER. Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often. For security reasons TAP and other e-services are not available in most countries outside the.

Utah State Tax Commission. Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134. However the affected counties also have an interest in the.

Assessment sales ratio studies 1970- Series 16574. 2021 tax rates by tax area utah state tax commission property tax division tax area 001 - 0000 1010 beaver 0001519 0001519 0001519 1015 multicounty assessing collecting levy. Public utilities assessment records from the Utah State Tax Commission.

Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often.

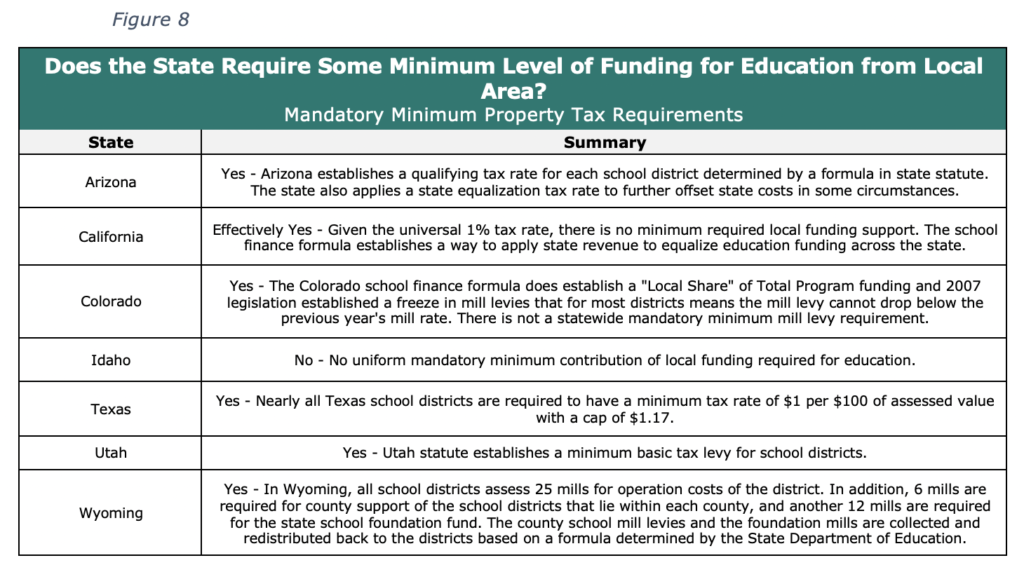

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Tangible Personal Property State Tangible Personal Property Taxes

Utah Tax Break Program Could Be A Lifeline For Seniors

Find Utah Military And Veterans Benefits Information On State Taxes Education Employment Parks And Recreation And Va Facility Locations The Official Army Benefits Website

Property Tax Utah State Tax Commission Utah Gov

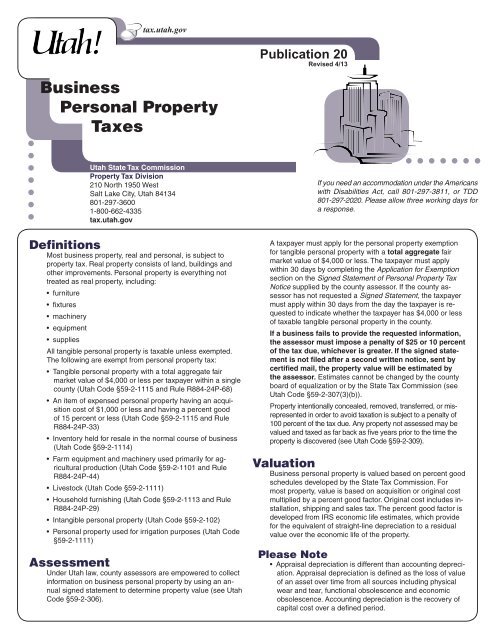

Pub 20 Utah Business Personal Property Taxes Utah State Tax

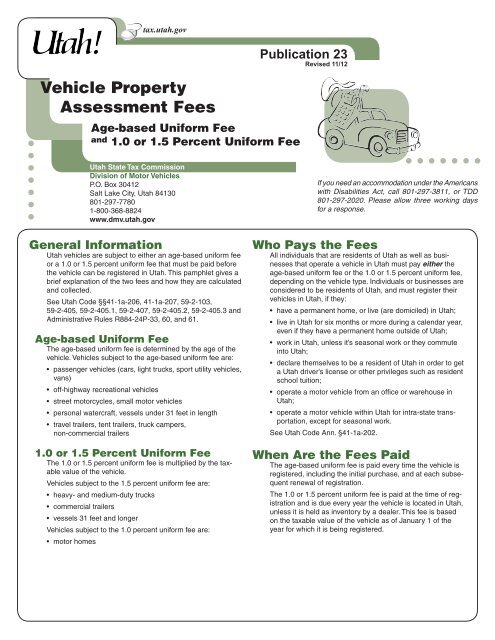

Pub 23 Utah Vehicle Property Assessment Fees Utah State Tax

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

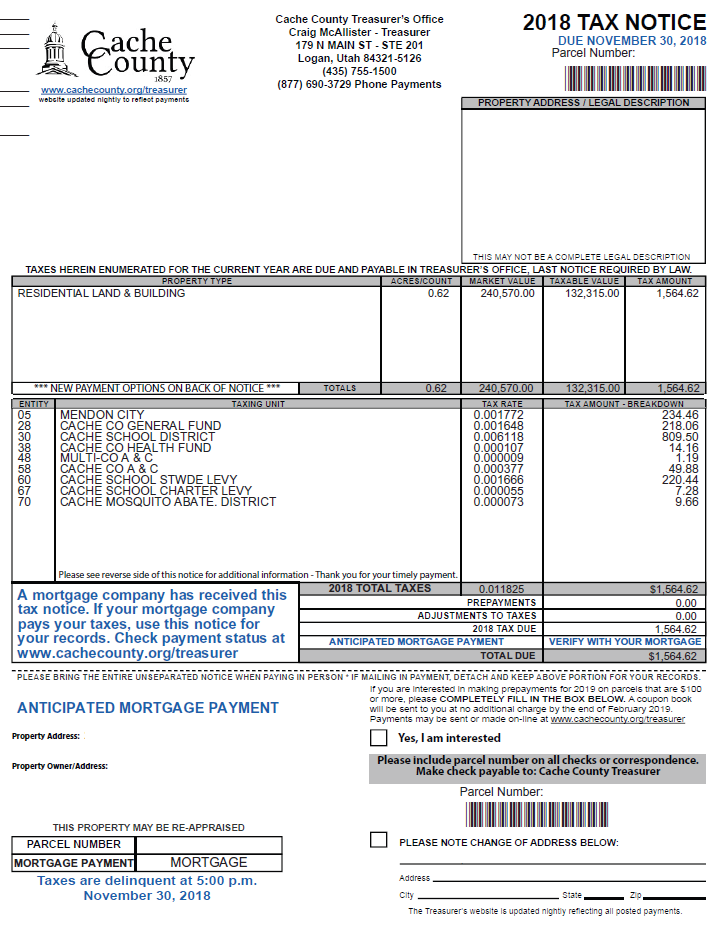

Official Site Of Cache County Utah Paying Property Taxes

Tangible Personal Property State Tangible Personal Property Taxes

Pub 20 Utah Business Personal Property Taxes Utah State Tax