utah state solar tax credit 2019

File electronically using Taxpayer Access Point at taputahgov. The utah solar tax credit officially known as the renewable energy systems tax credit covers up to 25 of the purchase and installation costs for residential solar pv.

Pin By Emmvee On Emmvee News News Personal Care

Refund of Tax Reported on Exempt Fuel for Utah Based Carriers.

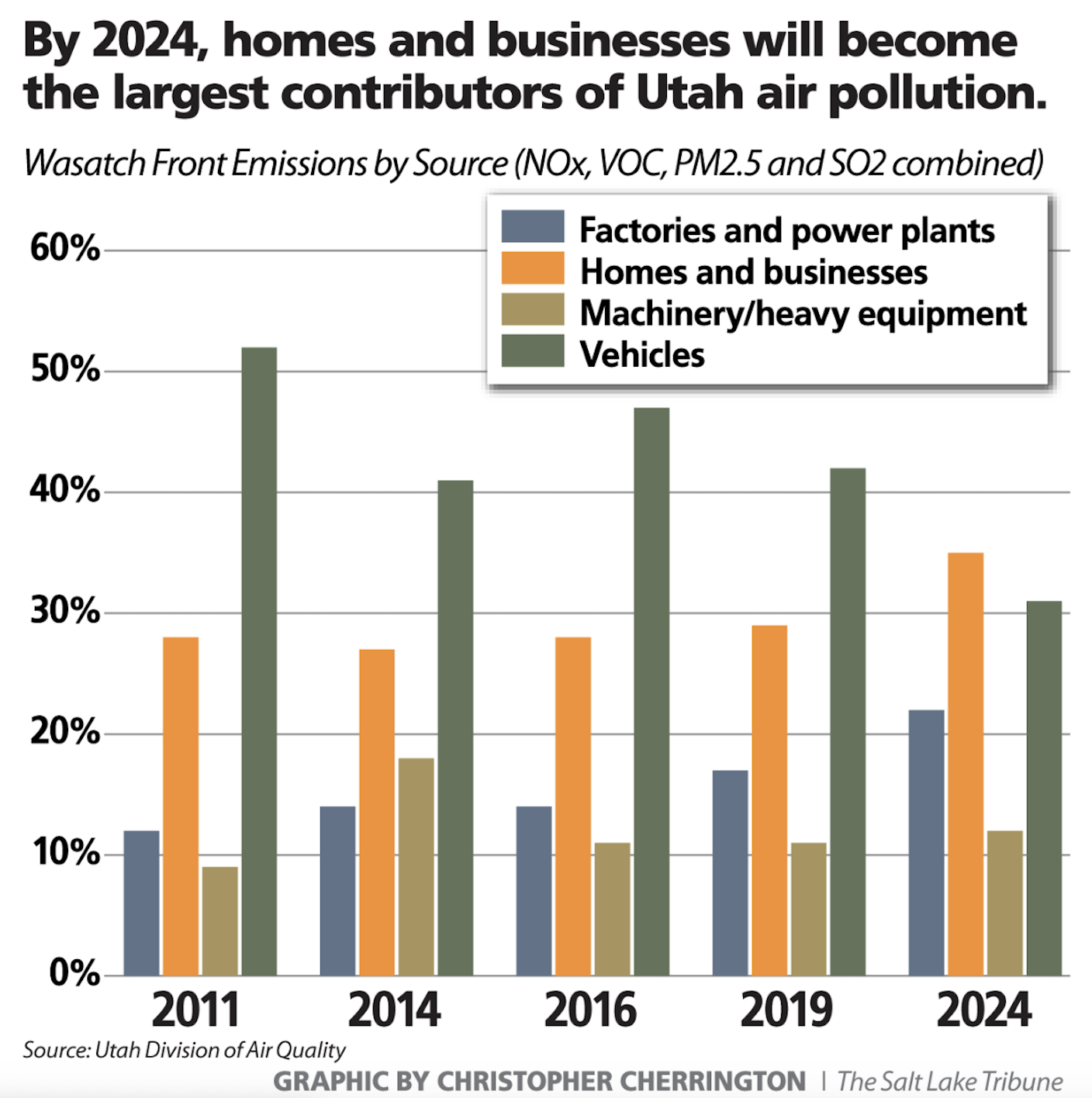

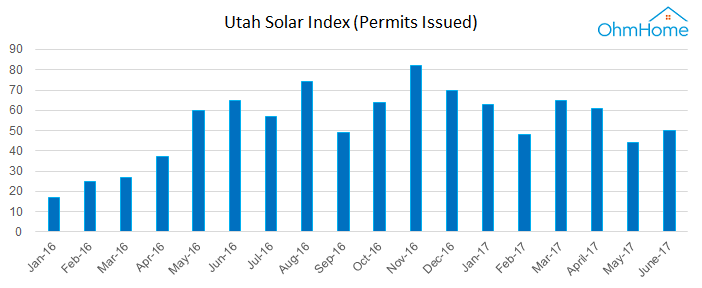

. Third quarter July-Sept 2020 quarterly filers September 2020 monthly filers Jan Dec 2020 annual filers. The graph below shows the average cost of installed solar systems in your part of the state. Utahs solar tax credit currently is frozen at 1600 but it wont be for long.

This tax credit was extended in 2018. And before 12312021 - 400. Claiming this credit now is ideal because after 2019 it will decrease to 26 percent.

Thats in addition to the 26 percent federal tax credit for solar not a bad deal for a system that can save you thousands each year on. Solar tax credit Everyone in Utah is eligible to take a personal tax credit when installing solar panels. Utah customers may also qualify for a state tax credit in addition to the federal credit.

Is a post-performance non-refundable tax credit for 75 of new state tax. This is 266 per watt. Write the code and amount of each apportionable nonrefundable credit in Part 3.

18 Retirement Credit. Dolla dolla bill yall. Utah Based Carrier Exempt Fuel Detail.

Attach TC-40A to your Utah return. What is the Utah solar tax credit. QUALIFYING FOR THE UTAH SOLAR TAX CREDIT.

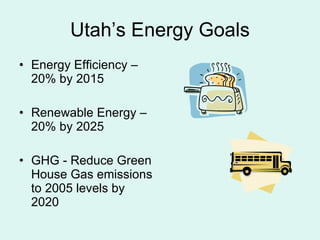

Over the past couple of years there have been changes to the tax incentives that homeowners can utilize when making the switch to solar. Currently Utah residents can claim 2000 on their state income-tax returns if they install a solar-energy system. The Utah residential solar tax credit is also phasing down.

Additional residential energy systems or parts may be claimed in following years as long as the total amount claimed does not. In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. With the new law that credit will steadily be reduced by 400 per year until its completely eliminated entirely after 2021.

Starting in 2021 it will resume its yearly phase down until this tax credit reaches zero at the end of 2023. In that list is Received a pre-approved credit from the state. Codes for Apportionable Nonrefundable Credits TC-40A Part 3.

High Cost Infrastructure Tax Credit. These are the solar rebates and solar tax credits currently available in Utah according to the Database of State Incentives for Renewable Energy website. Learn more and apply here.

Utah Governor Gary Herbert signed a new bill into law SB 141 that grants an extension to the states solar tax credit. This credit is for reasonable costs including installation of a residential energy system that supplies energy to a Utah residential unit. On the next screen drop-down list for Credit Description select Renewable residential energy systems.

Smart Energy USA can help you understand how much can you save on your utility bill. You can claim 25 percent of your total equipment and installation costs up to 800. Current federal and Utah solar tax credits offer an incentive to invest now.

The average cost for an installed residential solar system in Utah is currently 11797 after claiming the 26 federal solar tax credit. However there is some variance in solar prices in different parts of the state. It will start to decrease in 2021.

Before 12312020 - 800. The tax credit for a residential system is 25 of the purchase and installation costs up to a maximum of 1600. In 2019 this credit covers 30 percent of solar costs.

The Utah solar tax credit officially known as the Renewable Energy Systems Tax Credit covers up to 25 of the purchase and installation costs for residential solar PV projects capped at 1600 whichever is less. The amount that Utah taxpayers can contribute to their my529 accounts that qualifies for a 5 percent Utah state income tax credit or deduction was raised for tax year 2019. 04 Capital Gain Transactions Credit.

State Low-income Housing Tax Credit Allocation Certification. In the TurboTax Utah interview get to the screen titled Lets Check for Utah Credits Page 2 of 2. The new limit also allows.

This bill provides stability for the Utah solar market as it adapts to changes to rate structures and net metering. From 2018 to 2021 the maximum credit available for residential solar PV is 25 of eligible costs or 1600 whichever is lower. Utah solar customers would be wise to invest in solar before the available funding is no longer within their reach.

Renewable Energy Systems Tax Credit. And of course Utahns also benefit from the Federal Solar Tax Credit. Lets take a look at what the tax incentiv.

20 Utah my529 Credit formerly UESP. The Utah credit is calculated at 25 of the eligible cost of the system or 1600 whichever amount is less. It credits Utahans 1600 toward state taxes that would have been owed.

Utah offers a suite of tax credits for commercial projects that span significant infrastructure projects as well as renewable energy oil and gas and alternative energy installations. Federal tax credit its technically called the Investment Tax Credit. If you install a solar panel system on your home in Utah the state government will give you a credit towards next years income taxes to reduce your solar costs.

Before 12312019 - 1200. Utah state solar tax credit 2019. The state solar incentive is also a tax credit.

This form is provided by the Utah Housing Corporation if you qualify. Renewable Residential Energy Systems Credit code 21 Utah Code 59-10-1014. Customers who live in utah and south carolina may also qualify for a state solar tax credit in addition to the federal solar tax credit.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. To enter it in TurboTax please see the instructions below. All of our customers with a taxable income qualify for the US.

Effective January 1 2019 the maximum contribution limit for individuals Utah-based trusts and Utah-based corporations is 2000 per qualified beneficiary. The first reduction would be from 2000 to 1600 in 2018. Before 12312018 - 1600.

Alternative Energy Development Incentive. The bill extends the cap on the maximum credit each residential solar system can claim under the 25 solar tax credit by two years. Using the tax credits that are currently in place will reduce the cost of switching to solar by thousands of dollars.

Get a free consultation. Both of these tax credits will decrease over the next few years and end in 2025. This amount decreases by 400 each year after until it expires.

Click the Yes button. Add the amounts and carry the total to TC-40 line 24. So when youre deciding on whether or.

Utah Solar Tax Credit Everything You Need To Know About

Utah Solar Tax Credits Blue Raven Solar

Utah Solar Tax Credits Blue Raven Solar

Understanding The Utah Solar Tax Credit Ion Solar

Overview Of Energy In Utah And Utah S Energy Goals

Utah Solar Utah State Incentives Prices Savings

How Does The Utah Solar Tax Credit Work Iws

Understanding The Utah Solar Tax Credit Ion Solar

Annual Updates To The Export Credit Rate Utah Clean Energy

Understanding The Utah Solar Tax Credit Ion Solar

Solar Panel Laws In Utah Solar Panels Network Usa

Assp Sounding Rocket Launches From Alaska Nasa Light Study Rocket Orange Wallpaper

![]()

Getting Your Solar Tax Credits In Utah Blue Raven Solar

Medical Tourism In Ho Chi Minh City Potential Yet Inadequate Medical Tourism Tourism Tourism Department

Electric Vehicles For Clean Air Utah Energy Hub

Utah State Tax Benefits Information

Cost Of Solar Panels In Utah Best Solar Companies Cost And Installation Ohmhome